Personal Cyber Insurance Coverage for Homeowners and Renters

The pandemic highlighted and escalated the enormous role that technology plays in our everyday lives. Covid-19 shifted the workforce into hybrid and even full-time work-from-home models, and cyber attacks have evolved as a result. With more people than ever working, studying, and entertaining their families from home, we’re reliant on technology now more than ever. From Smart phones to laptops, iPads to programmable thermostats and virtual assistants like Amazon’s Alexa, our lives and homes are much more “connected”.

Cyber criminals are well aware of our increased “connectedness” and are taking full advantage. In addition to scams related to the pandemic, cyber crime as a whole has increased by 600% since the start of the pandemic and is expected to continue rising. (1)

While recent research suggests that Americans are aware that the risk has increased, many haven’t taken steps to safeguard themselves or their businesses. In fact, our partners at Chubb found that “68% of individuals report becoming “somewhat” or “much” more concerned about a cyber breach in the past year. Only 12% of Americans purchased a personal cyber insurance policy in the past year to protect themselves from cyber exposures.” (2)

It is no longer a matter of “if” you’ll experience a data breach or some type of cyber crime incident, but “when”. Personal Cyber Insurance coverage added onto your existing home or renters insurance policy can provide peace of mind that you are covered if you fall victim to cyber crime.

Our Homes Are “Connected”

Do you have any of the following:

- a server connection for work on your home laptop or phone,

- a banking app on your phone,

- an app on your laptop or phone to access work emails,

- an online account for your doctor’s office or health insurance that you access from your laptop, or

- an online account to manage your 401K and other investment accounts on your iPad?

People’s homes act as offices, class rooms, and more. Homes are now equipped with virtual assistants like Alexa, Siri and Google Home. We use apps to operate everything from virtual meetings, to TVs, light bulbs and thermostats. Statista reports that, “the number of smart homes in the market in the United States is expected to be 77 million in 2025.” (3) While increased connectivity facilitates remote work, virtual learning and more, increased connectivity also means increased risk of cyber crime.

The Risks of Connectivity

While more technology brings added convenience into our lives, the rise of tech is not without risk. As more technology is integrated into our lives, the odds of our personal data being compromised also increases. Each connected device allows opportunities for hackers and cyber criminals to steal personal information, commit fraud, or even extort money.

Each day the news reports on the latest corporation to fall victim to a data breach or cyber-attack. Many people don’t realize that individuals face many of the same risks as businesses, including:

- virus and malware attacks

- data breach

- fraud

- phishing

Consider the following scenario:

A senior citizen receives an email from her granddaughter, who is currently traveling with her roommate. The granddaughter says she caused a car accident and needs money for a lawyer. The granddaughter is afraid to tell her parents or ask them for the money. The grandmother then receives another email from her granddaughter’s lawyer which includes, a copy of the accident report and details the injuries of the victim. The victim will accept $6,000 for his medical expenses and will sign a release, dropping all charges upon receipt of the money. The grandmother wire transfers the money as instructed, only to call her granddaughter and discover the story was untrue, and she had been a victim of fraud.

More frequently cyber criminals are going after individual homeowners and renters, as they are easier targets than businesses with more sophisticated security measures. In fact, “1.4 million people reported identity theft in 2020, double that of 2019, according to the U.S. Federal Trade Commission.” (4) That number for 2021 is predicted to increase substantially.

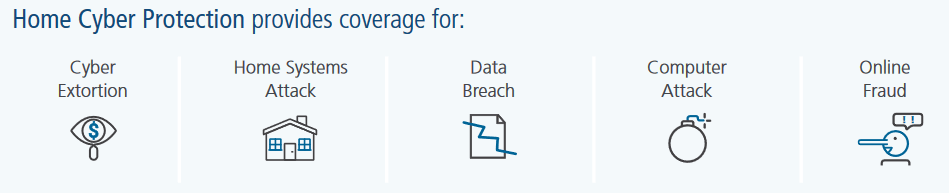

What is Home Cyber Protection Insurance and What Does it Protect Against?

Home Cyber Protection Insurance also referred to as a Personal Cyber Insurance policy is offered as an endorsement to a homeowners insurance or renters insurance policy.

Source: Safety Insurance “Home Cyber Protection Coverage”

Some companies also offer cyber bullying protection as part of a Home Cyber Protection policy. The cyber coverage provided varies depending on the insurance carrier but most personal cyber policies include:

- Coverage to restore systems and recover data that has been lost or damaged due to a cyber-attack, including attacks from malware, unauthorized use of computers, mobile devices and connected smart home devices.

- Payments for responding to cyber extortion demands based on a threat to damage, disable, or disseminate information from devices or computer systems.

- Payments for services to notify affected individuals, whose private personal data is breached.

- Protection for online fraud resulting in a direct financial loss to a covered policyholder.

Is Home Cyber Protection Coverage Affordable?

Many insurance companies offer some form of Personal Cyber Protection, as an endorsement that can be added onto a homeowners or renters insurance policy. Cyber Protection Coverage is surprisingly affordable.

Safety Insurance’s Personal Cyber Insurance endorsement covers $25,000 in cyber damages for only $36 annually. Similarly, Home Cyber Protection offered by Arbella Insurance covers $25,000 in cyber damages for only $42 annually or $50,000 worth of coverage for $52 per year.

With our homes increasingly “connected” by smart technology, we’re more vulnerable than ever to cyber-attacks. A hacker stealing your private, personal information can result in significant financial, emotional and reputational harm.

Steps You Can Take to Help Protect Your Data

It’s important to take steps to protect yourself and your information in today’s connected world.

- Always be careful with any personal information you provide online and make sure that the site you are providing them to is reputable and secure.

- Always use strong passwords and consider installing a password manager. A password manager will encrypt your information automatically and change your password each time you accept a site.

- Purchase a Personal Home Cyber Insurance Policy. Personal cyber crime is not something that can be prevented. A personal cyber policy will protect you if you fall victim to identity theft by paying any direct monetary losses relating to the cyber crime.

McSweeney & Ricci Insurance provides complete insurance protection for your home, car and business, as well as advice that results from over fifty-five years of experience.

If you would like more information on adding a Personal Home Cyber Insurance Policy to your existing home insurance or renters insurance policy, contact one of our experienced Account Managers by calling (844) 501-1359 or click here to request a complimentary quote.

Sources:

1)10 Cyber Security Trends You Can’t Ignore In 2021 – PurpleSec

2) Chubb: Online You Protected

3) • U.S.: number of Smart Homes 2017-2025 | Statista

4) Chubb: Online You Protected